September 2021

Detailing DE&I: Diversity, Equity and Inclusion Discussion Jumps in Annual Filings

Since the killing of George Floyd in May 2020, company boards and management teams have sharpened their focus on racial inequality through a variety of communication methods. Corporate America, under pressure from investors and other stakeholders, has since significantly increased its disclosures on diversity, equity and inclusion initiatives in annual securities filings, according to a Gladstone Place Partners analysis.

Gladstone Place reviewed all current S&P 500 companies for their comments around DE&I in their 10-Ks and proxy statements, examining the previous two years of filings made up until June 2021. Using two time periods – June 2019-May 2020 and June 2020-May 2021—allowed us to compare the filings of each company for the 12-month periods before and after Floyd’s killing.

Among the findings: in the year leading up to June 2020, only 14 percent of S&P 500 companies mentioned DE&I in their 10-Ks. In the year after, 88 percent did so, the data show. This trend bears out across industries and sizes of companies.

Benchmarking DE&I Discussion in 10-Ks

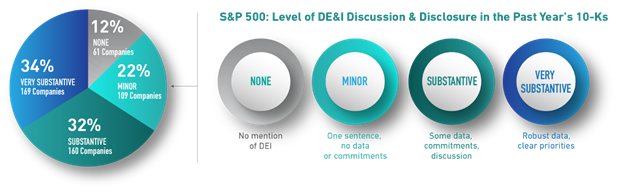

Drilling deeper into this trend, Gladstone Place rated the degree to which the companies discussed these programs in 10-Ks during the past two years, using four categories: 1) no mention, 2) minor mention, 3) substantive mention, 4) very substantive mention.

Based on our review of the filings, one thing is clear: there is no cookie-cutter approach to DE&I disclosures. The substance varies widely. Some make no mention of it at all, others go deep. Citigroup, for example, is at the forefront of detailed DE&I reporting in the 10-K. Citi was an early mover when it comes to instituting goals and incentives around hiring and promoting women and diverse employees, and that continues to carry over in its filings.

Gladstone Place found that many companies addressed DE&I in their latest 10-Ks for the first time, with a large percentage substantially increasing their discussion. In the year after Floyd’s killing, 138 S&P 500 members went from not mentioning DE&I anywhere in their previous 10-K to having a highly detailed section dedicated to the topic – the “Very Substantive” category in our methodology.

Companies in the “minor” category – one sentence with no supporting data – may soon discover that they are being called out for their lack of serious, full disclosure. Large institutional investors are demanding more detail on the matter, including by pushing companies to disclose data they already report privately to the U.S. Equal Employment Opportunity Commission. As a result, companies are getting more specific in their disclosures, including workforce data, internal initiatives and commitments, and progress scorecards. Beyond “checking the box” in a 10-K, we would advise all companies to consider more detailed analysis and discussion. One line on the topic is not best practice.

“Investors and stakeholders will be increasingly interested in seeing true commitment to DE&I statements that have been made over the past year. As a result, we should see an increased focus on such disclosures in proxy filings and 10-Ks over time,” said Anna Catalano, who has served on corporate boards for nearly 20 years and who is currently a director at manufacturer Appvion and oil refiner HollyFrontier Corp.

How to Use the 10-K

Gladstone Place’s research revealed that companies putting DE&I front and center are using the 10-K to map out specific initiatives with bottom-line implications, in a way that moves beyond what they would typically disclose in the proxy.

Case in point: Citigroup, Coca-Cola and Adobe.

Citigroup was an early leader in disclosing race and gender commitments, first mentioning employee diversity in its 2005 proxy and every proxy thereafter. For fiscal 2020, Citi included a Diversity section in its 10-K within its Human Capital Resources and Management section, which now includes initiatives and statistics as well as future goals around DE&I. Many of the stats illustrate the company’s hiring efforts to minimize gender and minority gaps within its workforce. One notable accomplishment disclosed in this year’s report: Citi had its most diverse intern class to date.

Along with releasing a separate detailed report around specific diversity initiatives, Coca-Cola discloses its multifaceted racial equity plan in its 10-K for 2020. This includes mapping out employee demographics by gender and race, highlighting business resource groups (BRGs), and future DEI goals. The company includes its commitment to be 50 percent led by women in a 10-year plan, reviewed by the Global Women's Leadership Council, that focuses on accelerating the development and promotion of women into roles of increasing responsibility and influence.

Adobe outlines its specific employee demographics as well as a four-pronged strategy to grow diversity over time. In a fully fleshed out DE&I section of the company’s 10-K, Adobe names new partnerships with organizations that are dedicated to advancing diversity for recruiting efforts such as AfroTech, BreakLine, Techqueria, Grace Hopper Celebration of Women in Computing, and Lesbians Who Tech Summit. The company also describes several initiatives targeting workplace inclusion, and social justice and economic inequality.

For companies taking these issues seriously and keeping a close ear to investor and stakeholder demands, the message is clear: When it comes to DE&I, be specific and detailed, benchmark against peers and understand how expectations of Corporate America’s disclosures from investors continue to evolve.

–Connor Murphy, Keilley Banks and Cristiana Kamais